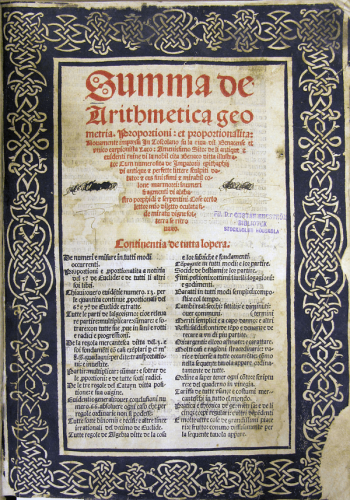

The invention did not only lead to the development of professional accountants. It was a long-lasting revolution that enabled trade, investment in other entities, taxation, the creation of the modern state, the development of public services…and a large number of activities and services we take for granted today.

In many ways, record-keeping has not changed significantly since then. Today, a whole class of certified and trusted professionals is still trained to keep records, enforce contracts, and validate transactions, more or less the same way as in 15th-century Venice. Because paperwork is expensive, corruptible and open to interpretation, this class of professional intermediaries is absolutely critical. There could be no trusted contracts and transactions without them.

And yet they could soon be replaced by technology. Many prophetise that blockchain technology will be the “

most significant advancement in record-keeping” since the invention of accounting. As the “

only incorruptible ledger” mankind has created, it has the potential to reshape how we structure and run organisations. A ledger that has no ownership, that is shared publicly, distributed among thousands of computers and continually reconciled, a blockchain does away with the need for middlemen to enforce compliance. Unlike traditional records that can be manipulated by unscrupulous bureaucrats, or forged by dishonest parties, with blockchain technology there is no central database for attackers to corrupt. (See

Wikipedia: “

a blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp and transaction data. By design, a blockchain is inherently resistant to modification of the data.”)

No powerful intermediary is required to authenticate blockchain transactions. With the use of state-of-the-art cryptography, there can be global, distributed databases that can record the fact that a transaction has been made. It can also record any type of structured information, including anything related to authentication and trust. Thus the very

raison-d’être of a number of professions—lawyers, solicitors, notaries, chartered accountants…—will be (at least partly) challenged. One can easily imagine the transformational power of such technology: it can make transnational transactions safer, facilitate contracting between various entities, and ultimately it could render the old

theory of the firm somewhat obsolete (and firms themselves).

How regulated professions may be challenged and what it means for individual workers

In their ground-breaking book titled

The Future of the Professions (see my

summary of their book here), Richard and Daniel Susskind argue that AI and platforms are challenging the future relevance of the professions as we know them. Though the authors do not mention the role of blockchain technology in particular, what they write certainly applies to its consequences on the relevance of professional work. Some of these professions were built on the necessity to establish trust between contracting parties and enforce the contract. And this particular technology makes this aspect of their work irrelevant.