What is the carbon tax at EU borders?

The European Union (EU) has launched the first phase of its Carbon Border Adjustment Mechanism (CBAM ). Carbon Border Adjustment Mechanism) to impose CO2 emission tariffs on a range of imported products, including steel and cement. This initiative aims to preserve the EU's commitment to sustainable development by preventing the influx of environmentally damaging foreign products that could jeopardize its ecological transition.

In effect, the border carbon tax is a border carbon adjustment mechanism designed to protect our European industries in their decarbonization plan.

For the moment, however, this is a blank application before the actual start-up scheduled for 2026.

How does the EU carbon tax work?

Importing companies must now :

- declare their imports from abroad of the most polluting raw materials, notably steel and aluminum;

- evaluate the CO2 emissions generated by their production.

It is on the basis of these calculated emissions that, from 2026, the carbon tax at EU borders will be imposed. For the time being, however, manufacturers will only be required to report on their emissions, before they go through the checkout process in 2026.

The aim of this measure is to encourage all manufacturers, in Europe and elsewhere, to invest in limiting their CO2 emissions.

What impact will the carbon tax have on industrial markets?

From 2026, companies will have to purchase certificates to offset these CO2 emissions.

This will put them on an equal footing with EU industries that have to acquire permits on the European carbon market to mitigate their pollution.

For the time being, however, only reporting is required of manufacturers.

An example to better understand the consequences of the carbon tax

Let's take the example of a European company importing steel from China. It will have to declare emissions during production, and if these exceed the European standard, the company will be able to acquire a certificate at the price of CO2 in the European Union.

If a carbon quota market exists in the country of production, but with a lower carbon price than in Europe (as is currently the case in China), the importing company will pay the difference.

In short, the idea is simple: make it equivalent to produce steel in Europe or outside, and encourage our trading partners to step up their climate action by raising the price of CO2.

From the point of view of the European Union's finances, this tax could bring in around 3 billion euros by 2030.

This measure will equalize the price of carbon between domestic products and imports. In this way, EU climate policies will not be jeopardized by the relocation of production to countries with less ambitious environmental standards, or by the replacement of EU products by more carbon-intensive imports.

Official press release from the European Commission

In the short term, the EU should seek to broaden the range of MACF exemptions and redistribute the revenues generated by the mechanism to the Union's trading partners. More generally, the EU should also examine the overall impact of the MACF from a geopolitical point of view.

Thomas bordenave, SENIOR MANAGER IQO

In a nutshell

Analyzing the international impact of the EU carbon tax will not be an easy task due to the uncertainties associated with the design and scope of the carbon tax regime.

Firstly, the scope of the BAM (Border Adjustment Mechanism) will most likely be extended to other EITE (Emission Intensive Trade Exposed) goods, which would radically alter its overall impact on the EU's trading partners.

The treatment of indirect emissions introduces another layer of uncertainty.

The MACF's impact on international business development has prompted, and will continue to prompt, debate on ways to mitigate the mechanism's potential negative impact.

In the short term, the EU should seek to broaden the range of MACF exemptions and redistribute the revenues generated by the mechanism to the Union's trading partners. More generally, the EU should also examine the overall impact of the MACF from a geopolitical point of view.

In any case, this is an important and ambitious step towards reducing the most polluting industrial activities!

Further information

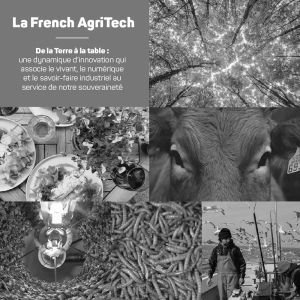

How should banks support AgriTech financing?

Banks have a key role to play in supporting the financing of AgriTech in France. French agriculture as a whole is faced with a number of challenges

PRODURABLE 2021: finance at the heart of positive-impact business approaches

From September 15 to 17, 2021, the PRODURABLE trade show was held in Paris. The PRODURABLE trade show is Europe's largest gathering of actors and

The growing risks of Greenwashing and Purpose washing

The climate emergency and the search for meaning and responsible brands are driving companies to multiply their initiatives, not only to do no harm, but above all, to ensure that the environment is protected.