Knowing how to manage contractual risks means knowing how to anticipate and avoid financial losses due to a buyer failing to honor a contract, or a company failing to properly manage contractual obligations and benefits.

Anticipating and managing contractual risks is not something you can improvise, and here are a few keys.

Contents

Contractual risk management and the myth of Sysiphe

Tireless Sysiphe! As a Project Manager or Contract Manager, you've no doubt already had the painful experience of seeing a schedule drift off course. Not to mention a deteriorating quality of execution and, ultimately, a deteriorating economic performance as the project progresses.

And yet, you have deployed considerable resources to counteract the bad news and turn things around. But to no avail: economic performance is not up to scratch, and you have the impression that "something" has got away from you. You're left with the unpleasant sensation of not having mastered the succession of events that led to this situation.

Have you ever dreamed of better understanding why "so many difficulties" arise? And to better anticipate and manage these contractual risks?

If this sounds like you, then read on - this article is for you!

Let's rewind the film of contractual risk management: the devil is in the complexity

Yet it's easy to recognize complex projects

- They involve, at the interface, a multitude of players with often divergent interests.

- They involve dozens - or even hundreds - of different contracts that have to be synchronized, with the risk that the failings of one will spill over into the others.

- Despite accumulated knowledge and experience in project management, the environment can sometimes throw up surprises due to factors external to the project.

Managing complex projects can't be improvised!

Let's be clear: managing a complex project or contract involving so many interfaces, parameters and constraints that need to be taken into account simultaneously, is not something you can improvise!

The risks of performance deterioration (cost/quality/time) are therefore numerous. They are often rooted in the preparation or execution of contracts.

So, for example, hasty contracting, the imposition of new requirements by the customer, project modifications or failure to monitor execution will have harmful repercussions, all the more so if the contractor is pugnacious, opportunistic or in a "tight" margin situation.

There's no shortage of examples

- Construction of the Channel Tunnel. A project that cost 75% more and was delayed by one year. What was the cause? The cumulative effect of signing the works contract prematurely, adding new requirements along the way, and the builder's contractual opportunism.

- CHSF (Centre Hospitalier Sud-Francilien). The emphyteutic lease was finally terminated due to, among other things, thousands of defects, some of which were so serious that they delayed patient admission for several months.

- The Athens Olympics. Numerous transport infrastructures were built, but 90% of the sports venues were abandoned after the Games. This construction work, the cost of which was not always well controlled, swelled Greece's public debt by 2 to 3%.

The result: a major deterioration in performance (cost/quality/time)

What these major projects all have in common is that, at some point in time, one or more events have occurred which have led to a cascade of disruptions, ultimately resulting in a significant deterioration in performance (cost/quality/time).

Now that these projects are over, let's dare to ask this "post-mortem" question: could we have prevented the chain of events? If so, how?

To manage contractual risks, let's start with a journey to the heart of risk management...

Traditionally, the project team lists dozens of operational risks, then analyzes them statically, one by one. The aim of this analysis is to anticipate and control the direct effects of these risks.

However, it omits the causal links between risks. These links generate indirect effects and chain reactions. They can then lead to the project spiralling out of control, and a situation that becomes difficult to control.

We can see here that the traditional risk management method is not sufficient to study runaway dynamics. Nonetheless, it remains necessary to understand each risk individually and prioritize action on the most critical risks.

The solution lies in identifying upstream the links between risks. But how can this be done? Is it possible and relevant to link risks together without adding further complexity?

The risk analysis framework needs to be completed!

- Define a set of contractual performance factors. These factors are generic, and can be transposed from one organization to another. They are limited in number to limit the complexity of the analysis and make them easy to learn.

- Analyze the dynamics of propagation between factors and their impact on operational risks.

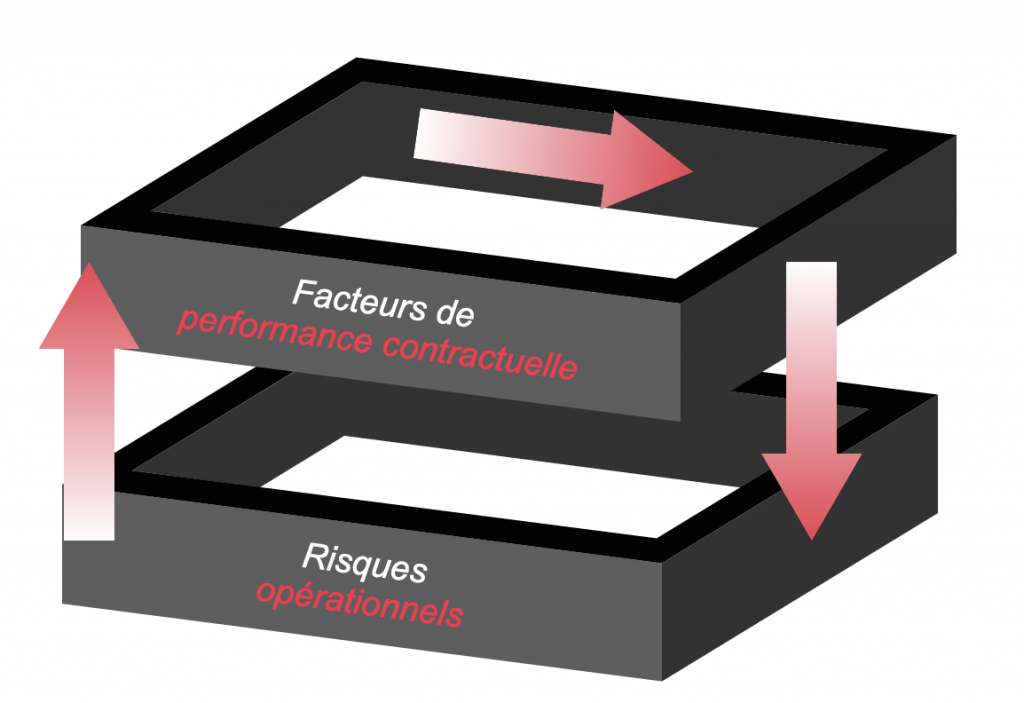

A two-level risk analysis framework (operational and contractual risks)

Our analytical framework is therefore based on two levels of risk management. Lower level: operational risks and higher level: contractual performance factors.

Compared with a long list of operational risks, which may contain dozens or even hundreds, our model only includes around twenty contractual performance factors. This methodology enables us to analyze interdependencies on a more manageable matrix.

Furthermore, the contractual performance factors we have identified are sufficiently generic to apply to all business sectors.

Case study in contractual risk management: analysis of propagation chains

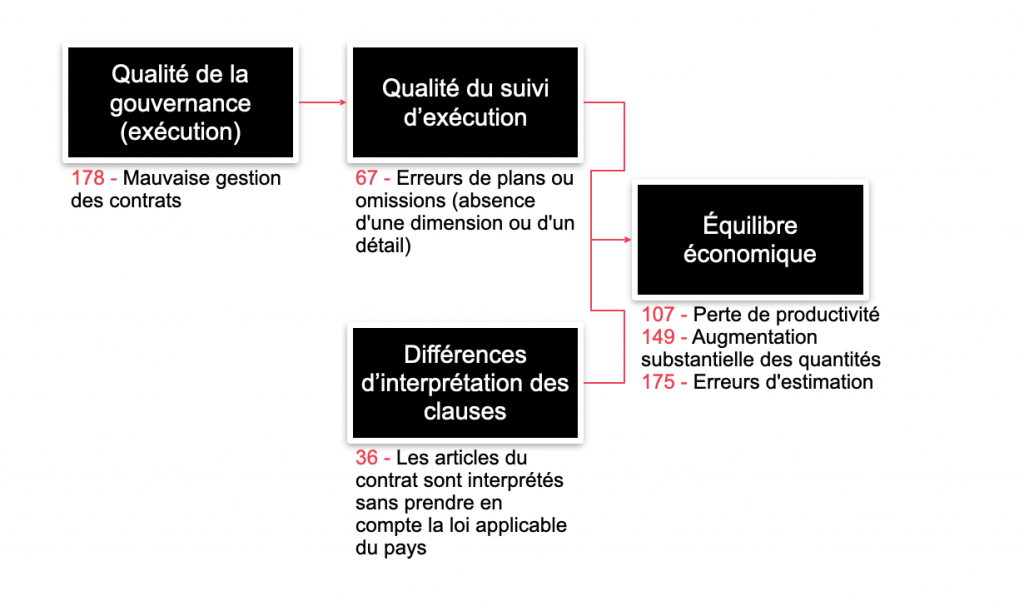

Once the risk-factor links and the links between factors have been mapped, we can trace the propagation chains.

Starting with an original risk (here n° 178), we identify the factor immediately impacted (quality of governance during contract execution). We then propagate step by step to the other factors (black rectangles), identifying the associated risks for each factor.

Viewing these chains highlights :

- Non-obvious links between causes and effects that are far apart. For example, poor contract management can lead to planning errors.

- A "path" or chain of events with a high occurrence or impact, on which classic risk management strategies can then be deployed.

Managing contractual risks at every stage

The results obtained to date on real-life cases tend to validate the relevance of our framework, which can be used at any stage in the life of a contract.

- Upstream of contract signature, to anticipate indirect risks that could arise either during contractualization or during execution, when impacts are on a much larger scale.

- During the execution phase, to diagnose the situation of a project or contract and prioritize actions to be taken.

Our method has also been successfully applied to the post-mortem analysis of a construction project, confirming the possibility of detecting, at a very early stage, weak signals whose control would undoubtedly have enabled us to better anticipate, and therefore prevent, the occurrence of major risks.

Further information

How do you set up a Contract Lifecycle Management (CLM) tool?

Contract Lifecycle Management solutions are designed to automate contract lifecycle management. From drafting to closing,

Our research approach in Contract Management

The Contract Management website now plays a central role in a company's overall performance. Contracts are at the heart of business life:

Contract Management, a lever for contractual performance

The Contract Management website now plays a central role in a company's overall performance. Contracts are at the heart of business life: they govern,