Find out why "Positive Impact" initiatives by banks need to multiply. Ethical consumption has become a widely shared concern for many consumers, and the same applies to savings. What are our investments really financing? If 63% of French people say they are ready to invest in sustainable projects that meet ESG criteria, banks are in the front line to meet this need.

From the revolution in SRI savings and impact loans...

We pollute more through what our money in the bank finances than through our own consumption.

Alexandre POIDATZ

Faced with the challenges of global warming, worsening inequalities and, more generally, the search for meaning highlighted by the recent economic and health crises, the French have become aware of the urgent need for individual and collective action to change their lifestyles and consumption patterns. Beyond the purchase of organic foodstuffs or goods and services in short circuit or positive-impact goods and services, the question now arises of how toallocate household savings. Whatever our efforts to consume better, we have to admit that " we pollute more via what our money in the bank finances than via our own consumption ", emphasizes Alexandre Poidatz in a report byOxfam.

We are seeing the emergence of new players with the promise of traceability of savings and loans granted by banksand the guarantee of a positive impact on local communities. Whether they are fintechs (Helios, Triodos, Green-Got, OnlyOne), ethical ethical banks such as Nef, or new structures within existing banks, such as Banque Populaire Auvergne Rhône Alpes' Banque de la Transition Energétique, which isolates SRI savings and associated financing from its balance sheet to guarantee its savers line-by-line project traceability.

In addition to SRI savings and impact loans, the Banks are also committed to climate issues in general, in line with the Paris Agreement, and are committed to remaining key players in supporting the economic and social fabric.

... to a collective commitment by the Banks to Positive Impact

Banks are now convinced of the need to make a commitment to positive impact. A Sustainable Finance Observatory was launched in Paris at the end of October, in conjunction with the French Banking Federation. French banks are stepping up their initiatives on environmental, economic and social issues:

On the offer and the relationship model

- SRI or dedicated low-carbon savings funds, green bonds and social bonds, and mechanisms for tracking and tracing the beneficiaries of financing granted (customer websites).

- Impact loans for individuals, businesses and local authorities to promote the ecological transition, energy renovation and eco-mobility.

- New life insurance contracts based on SRI and/or solidarity funds

- Special offers for customers in situations of financial fragility (budget support programs, waiving of intervention fees for some customers)

- Services for customers to estimate the carbon footprint of their spending

- Experts to support companies in their energy transition (real estate, transport/mobility, equipment)

On their investment and sponsorship policy

- Direct investments in sustainable innovation: equity stakes in greentechs, crowd lending or participative financing platforms focused on renewable energy projects, associations, and the launch of impact businesses, investment funds in innovation capital or in the social economy (Fonds Nov ESS).

- Territorial open innovation incubators

- Foundations and philanthropy for biodiversity, social integration and community projects

- Setting up green economy sectors

On assessing their footprint

- Development of stringent sectoral policies to measure the banks' footprint in the most sensitive sectors (creation of an indicator of French banks' exposure to coal, with an ambition of zero).

- New lending criteria that take into account the social and environmental impact of financing and, more generally, the inclusion of climate risk in risk policy.

- Voluntary participation in the first climatic stress tests organized by the ACPR

On their internal policy

- Use of renewable energy to power the branch network

- Diversity, inclusion and disability support systems for company employees

- Calls for employee initiatives and intrapreneurship

- Setting up communities to improve working conditions for employees

From scattered initiatives to the embodiment of Positive Impact at all levels and areas of the organization

Beyond scattered initiatives and the risk of greenwashing, the challenge for banks today is to build a global positive-impact strategy that highlights the sincerity of the approach and its consistency with the company's raison d'être. To achieve this, we believe 3 questions are fundamental:

- How can I contribute to a better world?

- How can I help my customers do this?

- How can I contribute to the well-being of my employees?

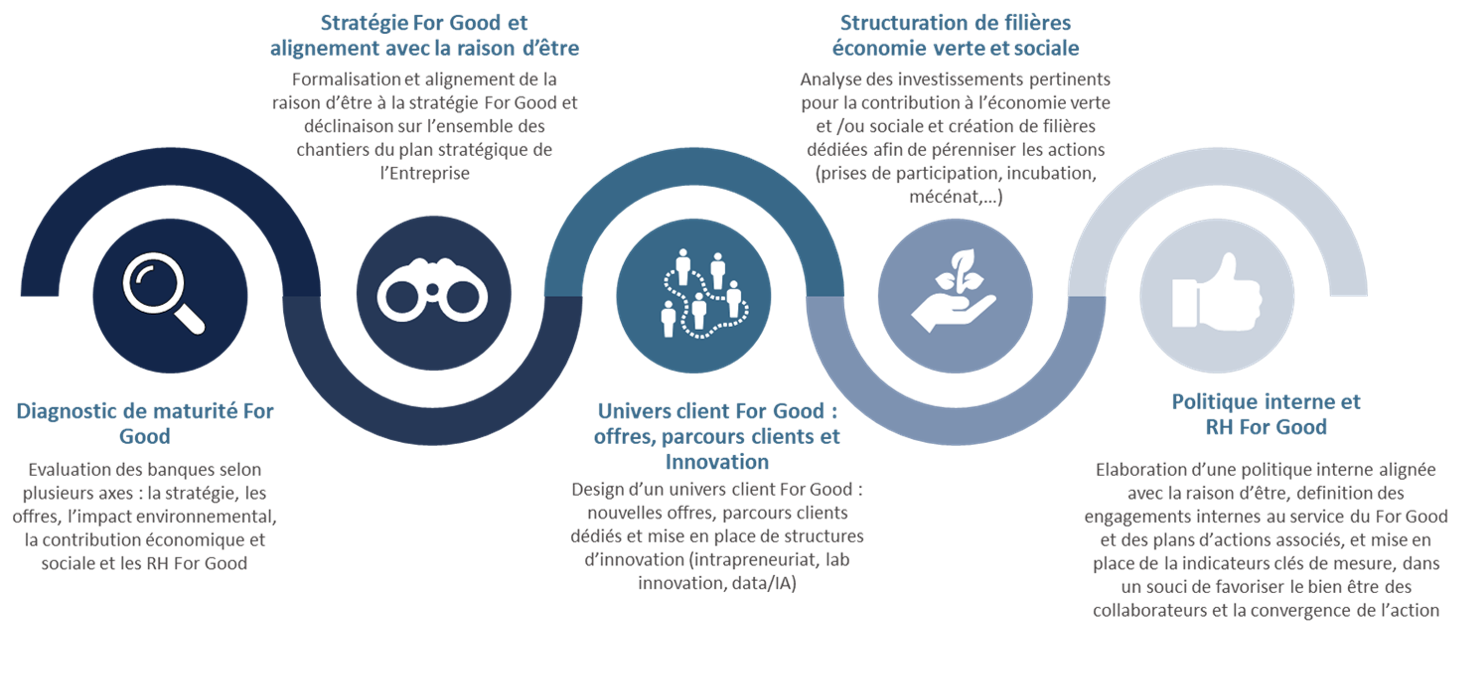

Reflecting on 5 dimensions to embody commitment and responsibility

Starting with a diagnosis of Positive Impact maturity

For banks, this reflection must begin with a diagnosis of their Positive Impact maturity, enabling them to establish priorities for action and, above all, to build a global Positive Impact strategy within the bank. This strategy must be aligned with the company's raison d'être/mission, and be applied to all the strategic plan's areas of focus, around dedicated ambitions.

The development of a positive-impact customer universe around innovative products and services is another major lever for the banks, in line with the high expectations of customers who, for want of anything better, could turn to specialized players. The challenge for banks is to move away from a patchwork of positive-impact offers, and build a complete range of positive-impact products and services, including day-to-day banking and insurance, with, for example, cash-back offers to reward customers' positive-impact consumption patterns, preferential rates on home insurance based on the environmental standards of the home, etc. This approach must go hand in hand with an overhaul of the customer's life cycle.

Positive impact of banks on society and the environment

As a key player in the local economy, banks can also have a positive impact on society and the environment through their investments, support and sponsorship of local sustainable projects. Structuring a green and/or social economy sector enables banks to organize and perpetuate their actions and the tools they can mobilize locally: venture capital and equity investments, incubation and acceleration of new players, creation of foundations or sponsorship, etc.

Finally, a bank with a positive impact addresses the aspirations and well-being of its customers as well as its employees. It must ensure that its behavior is exemplary in terms of internal policy, embody a benevolent collective, give meaning to the work of its teams, and guarantee employability, skills development, attractive career paths and inclusion for all employees.

Infuse Positive Impact at all levels of the company and break down silos to accelerate transformation

French banks have taken up the issue of Positive Impact and are today multiplying their initiatives. In the future, they will have to give even greater visibility and legibility to these initiatives by making them a core part of their strategy. In the same way, as with data and digital, the banks must ensure that they do not silo positive impact thinking and action. On the contrary, they must integrate it across all business lines and areas of the organization to accelerate and succeed in this unprecedented transformation.

Further information

B Corp certified mission company

From day one, we wanted to make iQo part of this commitment to change and sustainable impact. Behind this promise, we wanted to go even further

How to optimize the efficiency of a retail bank's support functions?

The efficiency of support functions is a key challenge for retail banks, reinforced by the current economic climate. Indeed, sustained inflation and the

The 7 challenges of retail banking

1. Get through the crisis and work on long-term strategy 2. Embodying its raison d'être, based on "Positive Impact" 3. Renewing the revenue and operating model